Advantages of Variable Costing Include Which of the Following

Standard costing is the second cost control technique the first being budgetary controlIt is also one of the most recently developed refinements of cost accounting. It is very easy.

Absorption costing is the conventional and standard costing method that is accepted under the US GAAP rules.

/dotdash-INV-final-Absorption-Costing-May-2021-01-bcb4092dc6044f51b926837f0a9086a6.jpg)

. It helps management analyze the material labor overhead cost Overhead Cost Overhead cost are those cost that is not related directly on the production activity and are therefore considered as indirect costs that have to be paid even if there is no production. Variable elements of total costs including situations involving semi variable and stepped fixed costs and changes in the variable cost per unitS c Explain the advantages and disadvantages of using the high low method to estimate the fixed and variable element of costingK. A few of the advantages of using JIT inventory include.

Purchasesassignments of inventory to WIP. This article will discuss not only the definition of absorption costing but we will also discuss the formula calculation example advantages and disadvantages. Costs are accumulated via transactions that occur for.

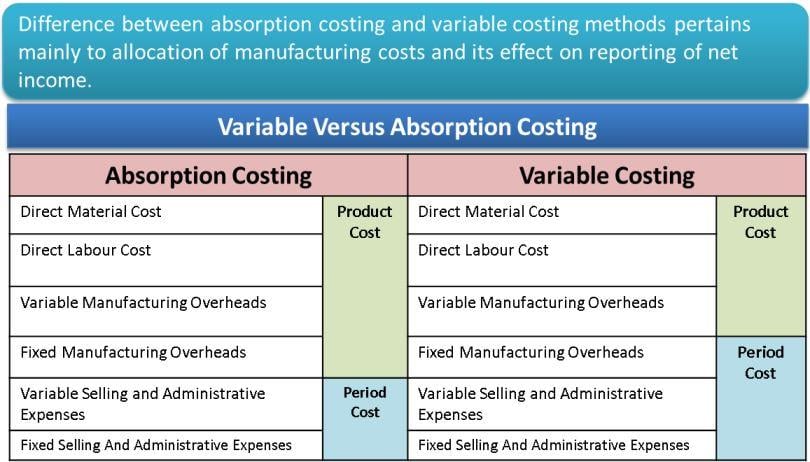

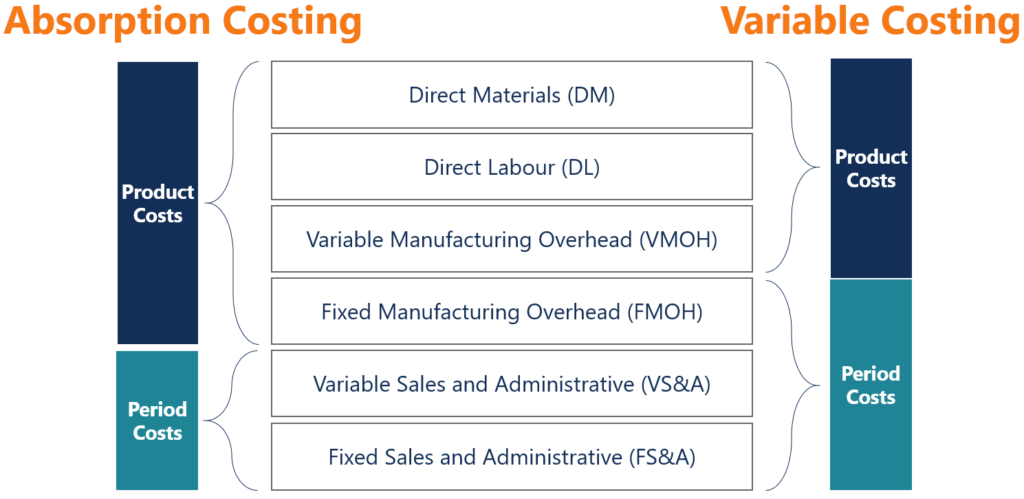

Click on the order now tab. Standard costing is a specialised technique of costing under which standard costs are pre-determined actual costs are compared with such predetermined costs the variations between the two are noted and analysed as to their causes so that corrective measures may be taken to control the factors leading to unfavourable variations. For your reference the following diagram gives an overview of costs that go into absorption costing compared to variable costing.

Standard costing is a system of accounting that uses predetermined standard costs for direct material direct labor and factory overheads. Products can absorb a wide variety of Fixed and Variable costs. Filling the forms involves giving instructions to your assignment.

Example of Absorption Costing. Students who have not yet mastered a style may have only some of a styles associated advantages rather than all of them. Other fighting style advantages might include.

I It results in earlier actions to generate revenue or to lower costs than otherwise might be considered. The following are the benefits of product life cycle costing. Variable costs per unit.

You will be directed to another page. The information needed include. Topic subject area number of pages spacing urgency academic level number of sources style and preferred language style.

Absorption Costing is a management accounting method for accumulating all costs associated with production in the value of produced inventory. To deliver good services it is also necessary to have a sound costing system. Costing provides valuable cost data.

In short it is an accounting method that records the costs associated with producing a good. Backflush costing is a product costing system generally used in a just-in-time JIT inventory system. Here there is a form to fill.

D Construct scatter diagrams and lines of best fit. What is Standard Costing Introduction. The advantages that managers derive from costing depend on the costing department particularly along the following dimensions.

Company A is a manufacturer and seller of a single product. It is also called full costing and is required for the external reporting of a company for it to be GAAP or IFRS compliant. In 2016 the company reported the following costs.

Ii It ensures better decision from a more accurate and realistic assessment of revenues and costs at-least within a particular life cycle stage. Thus all companies need to adopt this full costing method for reporting and compliance purposes. Job costing variable costing involves taking materials labor and overhead and accumulating them to a production process to create an items for sale or MTS to be sold later or to be used in future production.

Therefore it plays a vital role in managerial decision-making. The following business case is designed to help students apply their knowledge of Activity-Based Costing in a real-life business context. See if you can do the following after learning about JIT inventory.

Use the following advantage combos as examples of how to create different fighting styles. Any of these fighting styles might include ranks of the Close Attack advantage. Advantages of Costing.

The variable costing income statement is one where all variable expenses are subtracted from revenue which results in contribution margin Contribution Margin The contribution margin is a metric that shows how much a companys net sales contribute to fixed expenses and net profit after covering the variable expenses. The standard costing technique is. Those costs include direct costs variable overhead costs and fixed overhead costs.

It is sometimes called the full costing method because it includes all costs to get a cost unit. Absorption costing will also include any other direct cost variable or fixed that can be directly attributed to the cost of goods sold COGS.

Absorption Vs Variable Costing Resulting Difference In Operating Income

/dotdash-INV-final-Absorption-Costing-May-2021-01-bcb4092dc6044f51b926837f0a9086a6.jpg)

No comments for "Advantages of Variable Costing Include Which of the Following"

Post a Comment